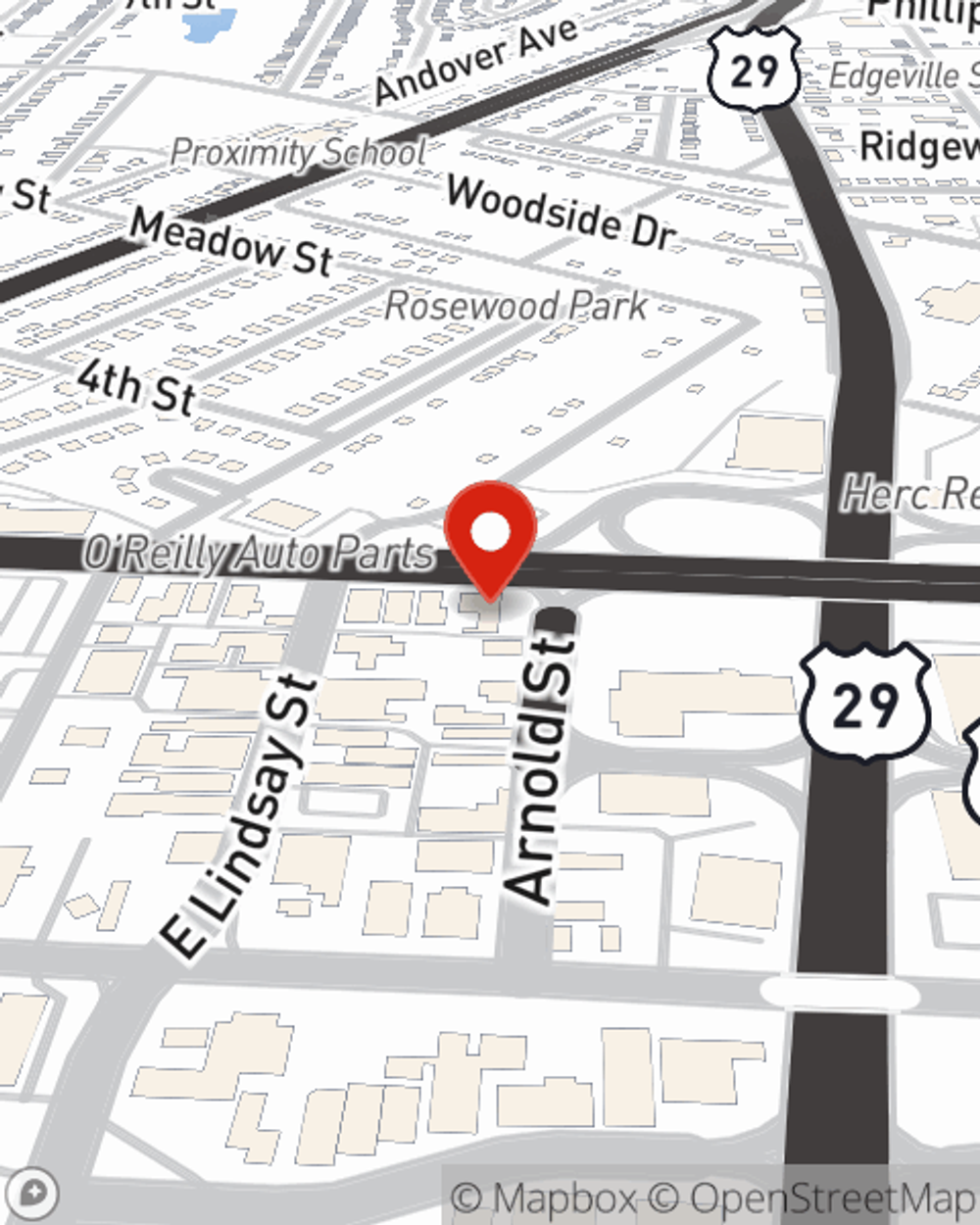

Business Insurance in and around Greensboro

Calling all small business owners of Greensboro!

Helping insure small businesses since 1935

Coverage With State Farm Can Help Your Small Business.

As a small business owner, you understand that the unexpected happens. Unfortunately, sometimes problems like a staff member getting hurt can happen on your business's property.

Calling all small business owners of Greensboro!

Helping insure small businesses since 1935

Insurance Designed For Small Business

With State Farm small business insurance, you can give yourself more protection! State Farm agent Jim Young is ready to help you handle the unexpected with dependable coverage for all your business insurance needs. Such individual service is what sets State Farm apart from other business insurance providers. And it won’t stop once your policy is signed. If mishaps occur, Jim Young can help you file your claim. Keep your business protected and growing strong with State Farm!

Do what's right for your business, your employees, and your customers by getting in touch with State Farm agent Jim Young today to identify your business insurance options!

Simple Insights®

How to collect rent from tenants

How to collect rent from tenants

There are many ways to collect rent from your tenants. It's important to consider the one that best suits your needs.

Key employee coverage issues

Key employee coverage issues

The death/disability of a key person can have a dramatic impact in a smaller business. Consider these questions to help determine discount factor percentage.

Jim Young

State Farm® Insurance AgentSimple Insights®

How to collect rent from tenants

How to collect rent from tenants

There are many ways to collect rent from your tenants. It's important to consider the one that best suits your needs.

Key employee coverage issues

Key employee coverage issues

The death/disability of a key person can have a dramatic impact in a smaller business. Consider these questions to help determine discount factor percentage.